Also known as SIM upgrade scam

Where it is usually done: Email (Phishing), SMS (Smishing), Voice Call (Vishing)

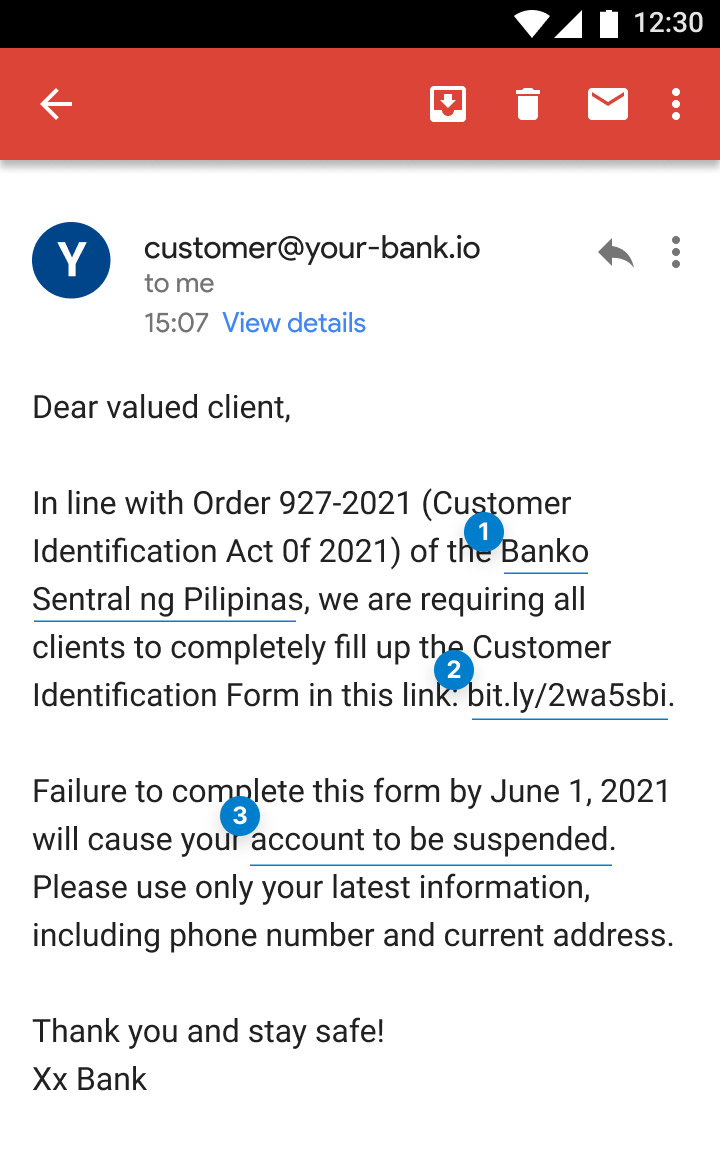

How it can look

- Scammers often use the name of authorities and respected institutions such as the BSP to make the communication look authentic.

- The link will lead you to a fake website that will steal your personal details.

- The threat of account suspension or closure is used a lot by scammers to scare people into performing an action.

- Scammers will pretend to represent your bank or provider.

Simulated. View image 🠑

What it is

This is when a scammer who claims to be from your bank, credit card company or other provider tries to get your personal information by asking you questions or making you fill up a form. The reason that is often given is to comply with regulations or because your account supposedly has incomplete details.

If you give your information, the scammer will use it to impersonate you and do things like open an account or take out a loan in your name.

Don’t be a victim of the identity theft scam. Never provide any personal details and never open any links from an email or SMS.

What you should do

If someone contacts you and says that a company needs you to provide your personal information for some reason, always verify this first by contacting the company using the official hotline. Remember, company representatives will never ask for your personal details or try to rush you into performing an action.

To help keep yourself scam proof, you should learn about the different types of scams so you know what to look out for. Read our scam types section and browse our tips to stay safe.